Frenetic developments in artificial intelligence have sent the semiconductor industry into overdrive, with the global chip market projected to grow by 15% in 2025.

TSMC is expected to benefit significantly from the rising demand for high-end semiconductor manufacturing. Although geopolitical issues pose challenges to the supply chain, China, which is facing multiple rounds of restrictions from the United States, continues to bolster its manufacturing capabilities in a bid to achieve self-sufficiency.

AI-themed chip production

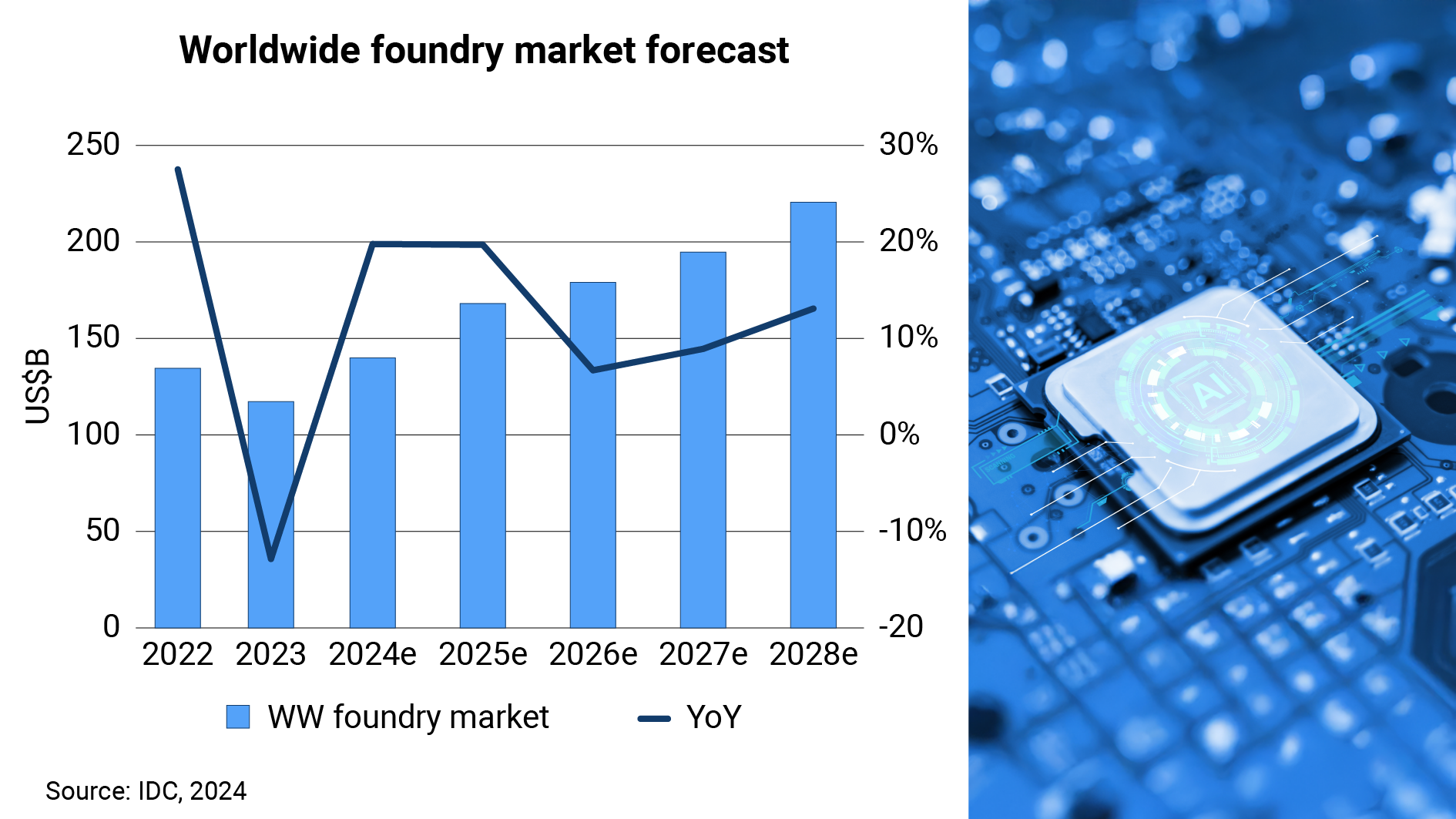

According to IDC’s latest Worldwide Semiconductor Technology Supply Chain Intelligence report, the global semiconductor market is poised to grow by 15% to over US$150 billion in 2025.

The memory segment is expected to surge by more than 24%, mainly driven by the increasing penetration of high-end products such as the high-bandwidth memory chips HBM3 and HBM3e, which are critical for AI accelerators, as well as the next-generation HBM4, which is expected to be introduced in the second half of 2025. Meanwhile, the non-memory segment is projected to grow by 13% amid strong demand for advanced node integrated circuits ( ICs ) for AI servers, high-end mobile phone ICs, and WiFi 7. The mature node IC market is expected to recover, supported by a rebound in the consumer electronics sector.

“In 2025, global semiconductor demand will be driven by AI rather than traditional devices. However, geopolitics and the tense relationship between China and the West will continue to trump economics when it comes to production decisions,” says Laveena Iyer, technology and telecoms analyst at Economist Intelligence Unit ( EIU ). “For chipmakers such as TSMC, AI will drive strong demand in 2025, while demand for traditional consumer electronics and devices will be more subdued.”

AI has been in high demand by organizations and tech giants alike since the debut of OpenAI’s ChatGPT, which propelled it into global prominence. With the heightened interest in generative AI and large language models ( LLMs ), AI-capable components and processes have seen skyrocketing demand throughout 2024.

With the introduction of AI-enabled smartphones and PCs, the demand for AI is expected to grow further. Edgewater Research predicts that 2025 will mark the true start of AI PCs, and according to Statista and market analyst Canalys, AI laptops will quickly account for over 50% of global PC shipments within the next few years.

TSMC pulls away from rivals

Under the traditional Foundry 1.0 definition ( pure-play foundry focused on wafer fabrication ), TSMC's market share is projected to climb steadily from 59% in 2023 to 64% in 2024 and 66% in 2025, far outpacing competitors such as Samsung, SMIC, and UMC.

In Foundry 2.0 ( which includes wafer fabrication, non-memory IDM manufacturing, packaging and testing, and photomask manufacturing ), TSMC’s market share was 28% in 2023. With rising demand for AI-driven advanced nodes, TSMC’s Foundry 2.0 market share is expected to grow rapidly in 2024 and 2025, demonstrating a well-rounded competitive advantage across both traditional and modern industry structures, according to the IDC report.

With the top wafer makers entering mass production of the 2-nanometre chip, 2025 will be a critical year for 2nm technology. TSMC is actively expanding its plants in Hsinchu and Kaohsiung, which are expected to enter mass production in the second half of the year. Samsung, following its past trends, is expected to enter production earlier than TSMC, while Intel will focus on 18A technology, which already integrates the Backside Power Delivery Network ( BSPDN ) as part of its strategic adjustments.

The three major 2nm players will face critical challenges in optimizing performance, power consumption, and cost per area. Key products such as smartphone application processors ( APs ), mining chips, and AI accelerators will simultaneously begin mass production. By then, yield rates for each player will improve, and the pace of production expansion will become the focus of market attention, says the report.

China works around US curbs

On December 3 2024, the US unveiled a new raft of restrictions aimed at the Chinese semiconductor industry, the third wave in three years, this time focused on chipmaking equipment, software, and HBM chips. The updated measures have added 140 Chinese entities to a blacklist, targeting firms seen as pivotal to China’s ambitions for semiconductor self-sufficiency through advanced manufacturing technologies.

The rules impose export curbs on equipment from manufacturers in countries such as Israel, Malaysia, Singapore, South Korea, and Taiwan, while granting exemptions to firms in Japan and the Netherlands. Among the exempted companies are Japan’s Tokyo Electron and the Netherlands’ ASML, two leading chipmaking equipment manufacturers.

China had already taken proactive measures before the latest curbs. In the first half of 2024, China spent a staggering US$24.73 billion on procuring chip manufacturing equipment, according to data from SEMI, a global semiconductor industry association. This figure exceeds the combined spending of South Korea, Taiwan, North America, and Japan during the same period.

SEMI predicts significant regional variations in semiconductor equipment spending growth from 2023 to 2027: China is expected to see a 4% decline, while robust growth of 22% is forecast for the Americas, 19% in Europe and the Middle East, and 18% in Japan.

Despite the decline, China will remain the world’s largest semiconductor manufacturing equipment market. From 2024 to 2027, the country’s semiconductor plant equipment spending is projected to reach US$144.4 billion, surpassing South Korea’s US$108 billion, Taiwan’s US$103.2 billion, the Americas’ US$77.5 billion, and Japan’s US$45.1 billion, SEMI data show.

In 2025, China’s packaging and testing market share is expected to continue rising, while Taiwanese players will consolidate their advantages in high-end chip packaging, especially for AI graphics processing units ( GPUs ). The overall packaging and testing industry is projected to grow by 9% in 2025, according to the IDC report.

“The US government will continue to impose restrictions on China’s access to semiconductors, targeting not just cutting-edge chips but also mature technologies. A Trump administration is likely to adopt a less collaborative approach, meaning that allies such as Taiwan, Japan, or the Netherlands will face tougher decisions in balancing their relationships with the US and China,” EIU’s Iyer says.