US President Donald Trump is threatening to expand his tariff war beyond America’s major trading partners to include Asian and other economies, all the while ignoring the massive surplus the US has with many nations in the area of services.

Even the Office of the United States Trade Representative ( USTR ) boasts that America has a huge invisible trade surplus as the world’s largest exporter of services.

And if America’s on-again, off-again tariffs on imports of Canadian, Chinese and Mexican goods are not really a trade war, but about combatting fentanyl and securing its borders, what are markets to make of his threat to impose “reciprocal tariffs” on trading partners from April 2?

As well, given the trans-Atlantic acrimony over Nato and the war in Ukraine with Europe in recent weeks, will Trump zero in on the EU?

Or will he broaden his focus to include Asia, notably the world’s emerging new manufacturing hub of Southeast Asia, whose merchandise trade surplus with the United States was in line with the EU surplus last year?

The short answer is — who knows? But in his record-breaking 100-minute address to a joint session of Congress on March 4, Trump made clear that China, India and South Korea were on his radar screen along with both North and South America.

‘It’s very unfair’

“On average, the European Union, China, Brazil, India, Mexico and Canada… and countless other nations charge us tremendously higher tariffs than we charge them,” Trump says. “It’s very unfair. India charges us auto tariffs higher than 100%. China’s average tariff on our products is twice what we charge them. And South Korea’s average tariff is four times higher.”

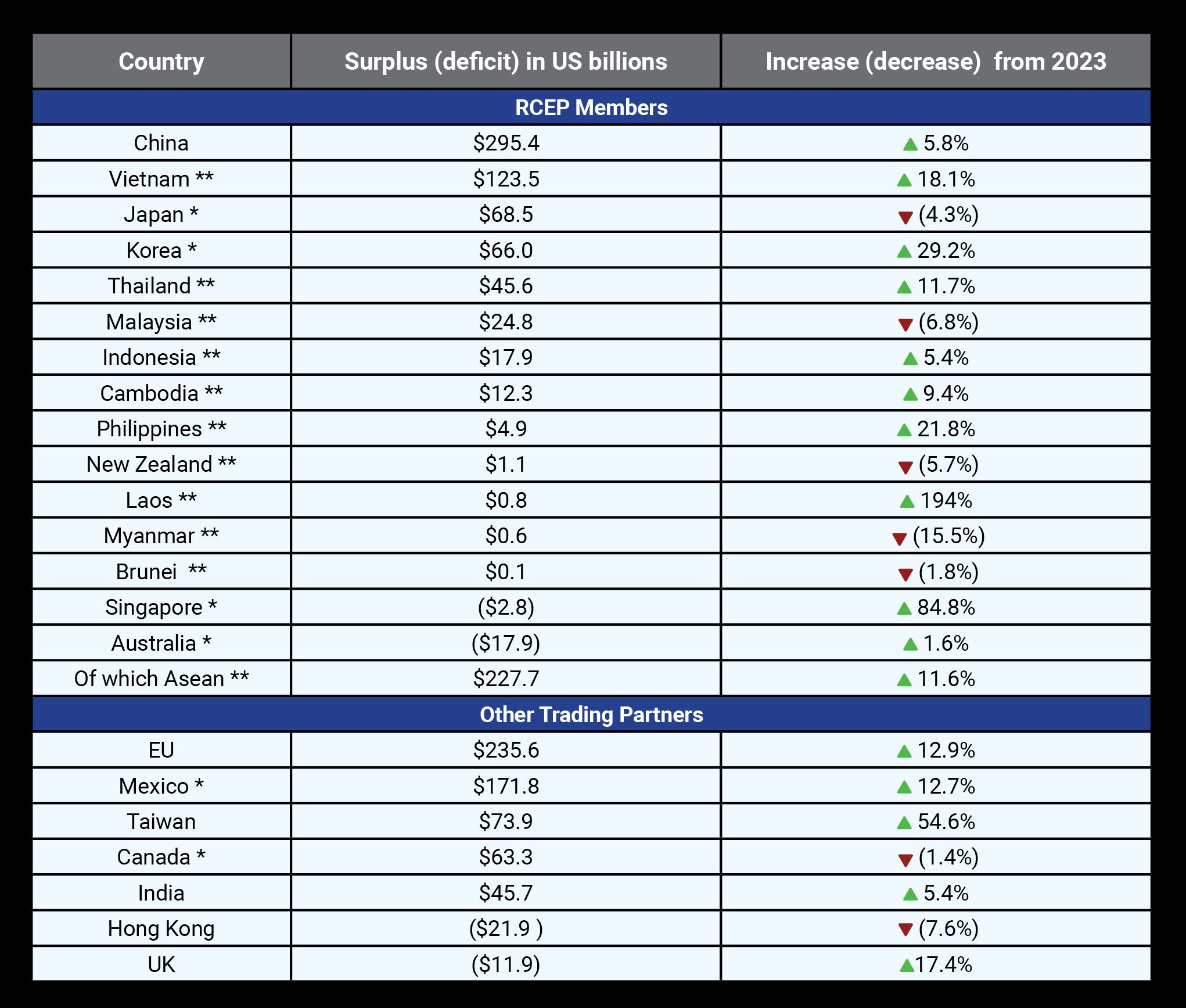

With the exception of Brazil, the trading partners Trump mentioned all have considerable merchandise trade surpluses with America. Last year, these ranged, according to the USTR’s Jamieson Greer, from India’s surplus of almost US$46 billion and China’s of US$295 billion – up about 5% from 2023 in both cases.

Together, the EU, China, India, Mexico, Canada and South Korea had a combined surplus of more than US$800 billion last year. ( Brazil had a trade deficit with the United States of US$7.4 billion, up one-third from a year earlier. )

Korea under greater scrutiny?

After China, “South Korea will probably be the first country in the region to feel renewed pressure,” says Robert Kelly, a professor of political science at Pusan National University. “Japan is America’s most important regional partner, so Mr Trump will probably proceed cautiously with Tokyo.

“But South Korea is a smallish ally of middling importance to the US, so it may find itself under greater scrutiny.”

China, South Korea and Japan are all members of the Regional Comprehensive Economic Partnership ( RCEP ), whose 15 Asia-Pacific countries make up the world’s largest free trade association.

After China, Vietnam had the next biggest surplus with America among RCEP members last year. It came to US$124 billion, up 18% from a year earlier.

Japan had the third-largest surplus of US$69 billion, down 4% from 2023, followed by South Korea at US$66 billion, up 29%.

Might Japan, South Korea get reprieve?

A possible Alaska gas pipeline could be a factor. In his speech to Congress, Trump said his administration was working on “a gigantic natural gas pipeline in Alaska — among the largest in the world — where Japan, South Korea and other nations want to be our partner with investments of trillions of dollars each”.

However, South Korean companies appear to have reservations. “While the Korean government said Seoul is closely looking at the project for cooperation,” the Korean Economic Daily reports, “Korea’s energy firms are sceptical about their participation, citing the costs and logistical hurdles.”

But Japan seems less cautious. Prime Minister Shigeru Ishiba said on March 5 that increasing US gas imports would “meet the national interests of both Japan and the US” by stabilizing Japan’s energy supplies and reducing its trade surplus with America. Ishiba told parliament: “We will carefully examine its technical possibilities and profitability.”

After China, Vietnam, South Korea and Japan, the biggest trade surpluses with America among RCEP countries in 2024 were with members of the Association of Southeast Asian Nations ( Asean ), other than Vietnam.

Asean’s combined trade surplus with America of US$228 billion last year was almost as large as the EU surplus of US$236 billion.

After Vietnam, USTR figures show that Thailand had the next-biggest surplus ( US$46 billion, up 12% ) followed by Malaysia ( US$25 billion, down 7% ), Indonesia ( US$18 billion, up 5% ), Cambodia ( US$12 billion, up 9% ) and the Philippines ( US$5 billion, up 22% ).

Laos, Myanmar and Brunei all had surpluses of less than US$1 billion. The remaining RCEP member with a surplus was New Zealand with an imbalance of US$1.1 billion, down 6%.

Others with US deficits

Australia and Singapore also had deficits with the US. Australia’s was $18 billion, up 2% from 2023, and Singapore’s swelled 85% from a year earlier to US$2.8 billion.

Among other major trading partners, deficits were also incurred by Hong Kong and the UK, which acceded to the Comprehensive and Progressive Trans-Pacific Partnership as its 12th member last year.

Hong Kong’s deficit grew 8% from a year earlier to US$30 billion, and the UK’s imbalance leapt 17% to US$12 billion.

Trump’s “personal disinterest” in Southeast Asia during his first term, according to Hoang Thi Ha and William Choong, senior fellows at the ISEAS–Yusof Ishak Institute in Singapore, is likely to be outweighed by his enthusiasm for tariffs, which “spell great trouble ahead for the region”.

Ironically, Asean benefited from the US-China trade war during Trump’s first term, they note, as companies shifted supply chains to the region to avoid higher US tariff on Chinese goods.

Exports to the United States by Vietnam, Thailand and Malaysia, Ha and Choong point out, at least doubled between 2017 and 2023.

Selected Trading Partners’ Goods Trade Imbalances with US in 2024

Currency manipulation

“These countries… will come under heightened scrutiny,” Ha and Choong posit, noting that Malaysia, Vietnam and Singapore were labelled as “currency manipulators” during Trump’s first term.

The USTR’s 2025 Trade Policy Agenda and annual report released on March 3 does not accuse Malaysia or Singapore of undervaluing their currencies.

However, the 207-page document devotes an entire section to a USTR probe dating back to 2020 on whether Vietnam’s “acts, policies and practices related to the valuation of its currency are unreasonable or discriminatory and burden or restrict United States commerce.”

The probe alleged that the State Bank of Vietnam’s forex management was “closely tied to the US dollar” and that the Vietnamese dong had been “undervalued for the past three years”.

In 2021, it determined that no action was warranted against Vietnam under Section 301 of the 1974 Trade Act, amended in 1988 to allow the USTR to take action against a broad range of foreign trade practices – the so-called “Super 301” provision brandished in America’s trade wars with Japan in the 1990s.

Vietnam, the USTR says, avoided punitive action with a “satisfactory resolution” under a State Bank of Vietnam agreement with the US Treasury.

US monitoring Vietnam

However, the US Treasury and USTR, the USTR document states, “continued to monitor Vietnam’s implementation of its commitments under the agreement and associated measures” last year.

America also engaged with Vietnam “throughout 2024” after talks on “agriculture, labour, environment, intellectual property, digital trade and services issues, and other bilateral trade concerns” in 2023.

Among other Asean nations, the document recalls meetings in 2024 with Cambodia on “protections for worker rights” and the Philippines to discuss concerns in agriculture, labour, government procurement, intellectual property, environment, auto safety and supply chains.

At the same time, the USTR continued to engage with Thailand “on priority economic concerns, including agriculture, labour, intellectual property, digital trade and customs cooperation”.

Uncertain future

Asean economies, Ha and Choong warn, risk being “caught in the middle” with tit-for-tat tariffs between China and the United States, the group’s two main trading partners.

“Asean exports to the US rely heavily on Chinese intermediate goods ( not to mention the re-routing and relabelling of Chinese goods going to the US via Southeast Asia ),” the Singapore researchers point out. “And Chinese exports to the US also use raw materials and intermediate goods from Asean.

“A sharp decline in Chinese exports to the US would also negatively impact Southeast Asian exports to China, which in turn would affect overall regional economic performance.

“In sum, the globalization model that Southeast Asia has long depended on for growth faces an increasingly uncertain future.”

Putting ‘America First’

The USTR document recalls the memorandum signed by Trump on January 20, which aims for “transformational change necessary to reverse our country’s economic decline”, ordering the USTR and other agencies to “undertake rapid, unprecedented work to put America First on trade”.

Specifically, it tells agencies to “investigate the causes of our country’s large and persistent annual trade deficits in goods, as well as the economic and national security implications and risks resulting from such deficits.”

“By reversing the flow of American wealth to foreign countries in the form of the trade deficit, the United States can reclaim its technological, economic and military edge.”

Moreover, Trump tells the USTR to “review our country’s economic relationship with all nations in order to identify their unfair trade practices, including where trading partners engage in non-reciprocal trade with the United States. By identifying, and acting against, such unfair and non-reciprocal practices, the United States can use its leverage to open new markets for US exports and re-shore the production that has been lost.”

No mention is made of services.

“The United States faces unprecedented economic and national security challenges,” the USTR’s Greer states. “President Trump has set out a plan to tackle those challenges.”

The Trade Policy Agenda, he adds, “lays out the thinking and vision that undergird that plan”.

Mexico, Vietnam, EU ‘exploiting’ America

The USTR document itself argues that the America First approach has bipartisan credibility as trade measures in Trump’s first term were retained by the administration of Joe Biden and even expanded.

New US trade representative Greer’s “deep understanding of economic, industrial and trade issues, especially his work to counter China’s efforts to undermine US economic and national security,” reckons Michael Stumo, chief executive of the Coalition for a Prosperous America, a group of manufacturers, workers and farmers, “will be crucial”.

“We are confident that Jamieson [Greer] understands how Mexico, Vietnam and the EU,” Stumo adds, “are exploiting America’s open economy for their advantage while not buying American-made products in return.”

US services surplus

All the trade bluster from the new Trump administration is, of course, misleading as it doesn’t take into account America’s invisible trade surplus in services like information technology, finance and entertainment.

“By the way,” Chinese foreign ministry spokeswoman Mao Ning reminded reporters at a regular press conference in Beijing on March 10, “the US continues to run a huge surplus in trade in services.”

The USTR even boasts that the United States is “the largest services exporter in the world” with exports of US$926 billion and imports of US$680 billion in 2022 – leaving an invisible trade surplus of US$246 billion.

Moreover, the USTR says, America’s exports of services accounted for almost a third of overall exports in 2022.

Silicon Valley, Wall Street, Hollywood chalk up surpluses

Ireland ranked as the top importer of US services ( US$83 billion ) followed by the UK ( US$81 billion ), Canada ( US$70 billion ), Switzerland ( US$52 billion ) and China ( US$42 billion ). EU imports of US services were US$239 billion.

Among bilateral imbalances in invisible trade, Canada suffered a services trade deficit with the United States of almost US$30 billion in 2022. The UK’s was more than US$1 billion, and the EU’s combined deficit was US$72 billion.

America’s manufacturing base may have been eroded by competition from China and Southeast Asia, but Silicon Valley, Wall Street and Hollywood are still chalking up surpluses, which reduce America’s broader current account deficit in both visible and invisible trade with the rest of the world.