Singapore-headquartered, Temasek-backed investment firm Clifford Capital has successfully priced its sixth public infrastructure asset-backed securities ( IABS ) transaction, Bayfront Infrastructure Capital VI ( BIC VI ), a wholly owned and newly incorporated distribution vehicle that represents its largest IABS issuance to date.

Clifford has now structured and placed six public IABS transactions, totalling US$2.7 billion since the inaugural BIC issuance in 2018.

BIC VI features a portfolio of approximately US$527 million in size, spread across 35 projects, 15 countries and 13 industry sub-sectors. BIC VI has the highest proportion of sustainable assets among the BIC issuances to date, with an initial aggregate principal balance of US$233.1 million of eligible green and social assets, representing 44.2% of the aggregate principal balance of the portfolio.

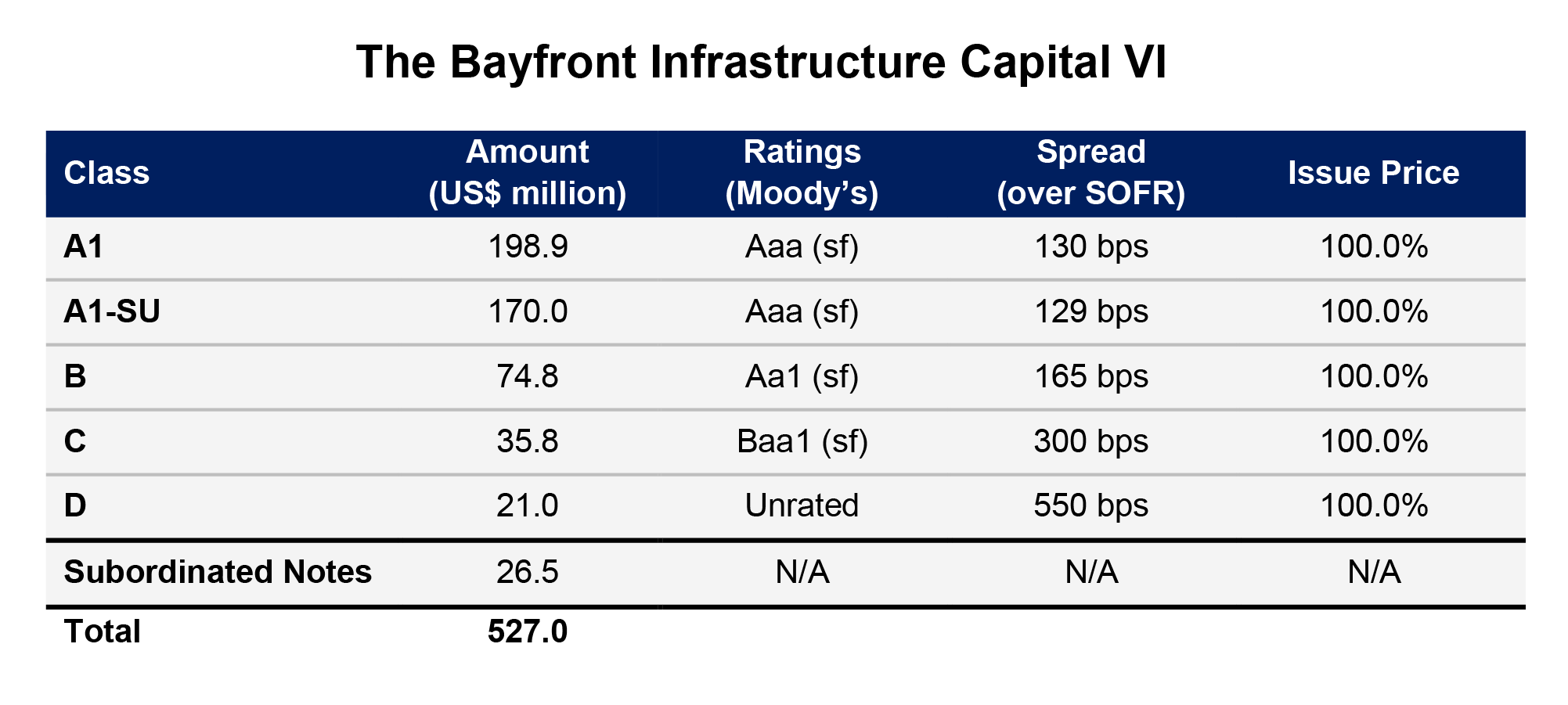

Five classes of senior notes – A1, A1-SU, B, C and D – of US$500.5 million in the aggregate principal amount were issued. The Class A1, A1-SU, B and C notes are rated investment grade by Moody’s. The Class D notes represent the first-ever unrated mezzanine tranche to be offered to IABS investors on an unguaranteed basis, following the guaranteed format that was used in the Class D notes in BIC IV and V.

All of the senior notes will be listed on the Singapore Exchange and are complying with EU and UK risk retention requirements.

Société Générale and Standard Chartered Bank ( Singapore ) were the joint global coordinators, while BNP Paribas, MUFG Securities Asia ( Singapore branch ) and Oversea-Chinese Banking Corporation were the joint lead managers.

The issuance was significantly oversubscribed, attracting demand from a variety of institutional investors, including bank treasuries, asset managers, insurance companies, pension funds, securities firms and public sector, across the three regions of Asia, EMEA ( Europe, Middle East and Africa ) and North America ( including US offshore ).