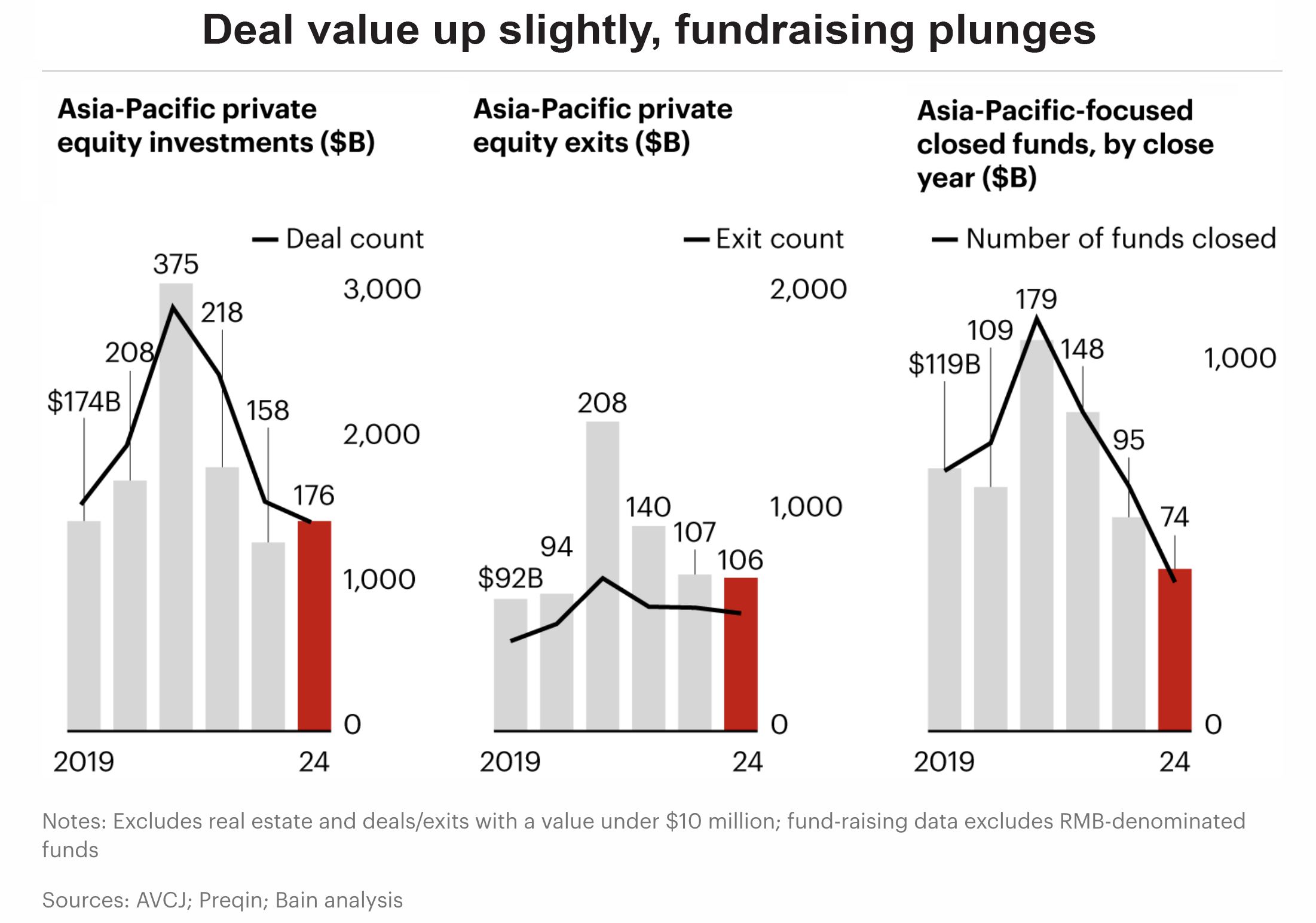

Despite macroeconomic uncertainties, Asia-Pacific’s private equity ( PE ) market is showing signs of recovery after two years of decline as deal value rose 11% to US$176 billion in 2024, according to a new report.

While moderate investments across the region support the recovery, deal count declined 9% from 2023.

Overall, Asia-Pacific deals were larger. Average deal size rose to US$133 million, up 22% over 2023 and 12% higher than the previous five-year ( 2019-2023 ) average, Bain & Company says in its Asia-Pacific Private Equity Report 2025.

The number of megadeals, or deals valued at US$1 billion or more, increased by 50% compared to 2023, lifting the average deal size.

Buyouts continued to be in favour as they accounted for over half of 2024’s total deal value. Notably, the share of buyout deals rose in traditionally growth deal markets, including India, Southeast Asia, and Greater China. Lower interest rates across most of the region also fuelled more buyouts.

In 2024, carve-out deals totalled 19% of all buyouts over US$100 million. Despite lower average returns, 44% of Asia-Pacific general partners ( GPs ) surveyed by Bain consider carve-outs a top investment opportunity, possibly due to immense opportunities in Japan and Korea when conglomerates rationalize operations and sell off business units.

“Investors are still wary of market uncertainty and so we continue to see them favouring buyouts as a way for greater control to manage risks and ensure a clear path to increase value. For those looking at carve-outs, it is essential to have an actionable value creation plan,” says Sebastien Lamy, co-head of Bain & Company’s Asia-Pacific PE practice.

“And while most markets in Asia-Pacific saw deal value rising in 2024, the actual dealmaking activity varied widely across the region. India and Japan are looking to be hotspots as their active investor pools have risen and major global PE funds are planning to deploy more capital in these markets.”

Market share down

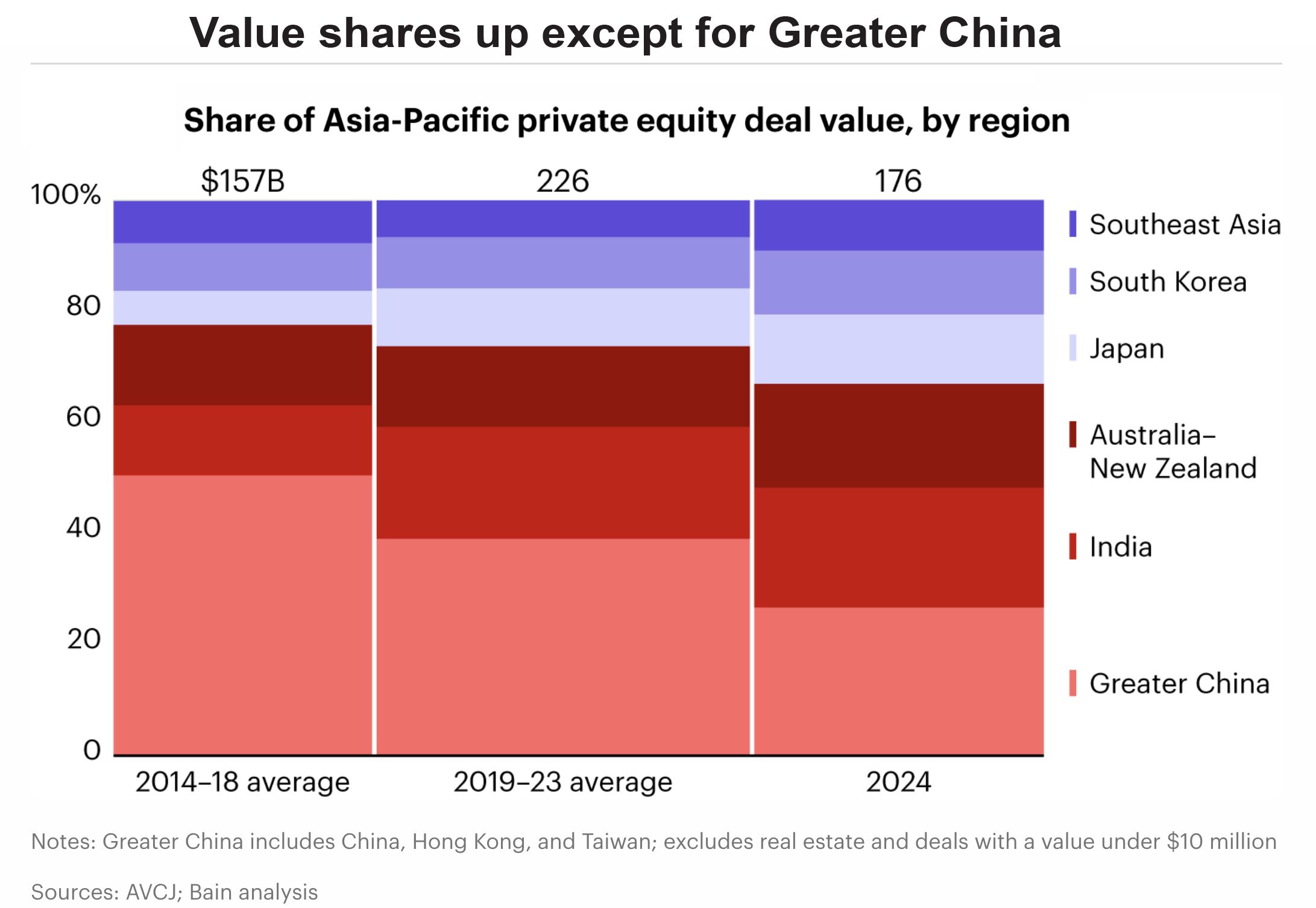

Greater China continued to lead with the highest deal value in the region, but deal value only rose modestly compared to 2023, and its share of the market continued to drop accounting for 27% of the region’s total deal value in 2024.

India was Asia-Pacific’s top performer, with deal value and count rising. The market remains one of the fastest growing in the region based on GDP, and investors are drawn to its strong growth fundamentals.

Australia–New Zealand’s deal value more than doubled, fuelled by the US$16 billion AirTrunk deal.

Japan’s deal count was unchanged, but deal value was down sharply compared to the previous year, which included multiple megadeals. In South Korea and Southeast Asia, dealmaking revived, with gains in deal value.

Some of the largest global fund managers with over two decades of investment experience in Asia-Pacific PE are shifting their focus away from China.

Last year, these GPs closed almost twice as many deals in Japan and India compared to the average from 2014 to 2018. Their investments in Greater China, by contrast, declined to less than one-third of the same period. Looking forward, major global PE funds plan to deploy more capital in India and Japan.

Among industries, technology continued to lead with the highest share of deal value and count across the region, but its share of deal value shrank to 25% in 2024, from 50% in 2018, as GPs sought greater diversity in their portfolios in an uncertain environment.

Investments in communications and financial services showed the highest growth rates in deal value over the previous year, powered by several large deals in data centres, and sizable deals in property loan and personal loan businesses in India.

Exit value and count up

Most markets saw some improvement in exit value and count in 2024, with India being the region’s largest exit market in terms of value and count, supported by a vibrant IPO market.

Due to a sharp decline in China’s exit market – partly driven by Greater China’s weak stock market performance – total exit value and count for the region were roughly flat, ending two years of precipitous decline.

For the third consecutive year, investors raising new funds ( excluding renminbi funds ) continued to face significant challenges. The value of Asia-Pacific-focused funds raised in 2024 slumped to a 10-year low of US$74 billion, down more than 20% from the previous year, and 43% lower than the previous five-year average. Global fundraising in 2024 was down 23%, excluding RMB funds, and Asia-Pacific’s share of global fundraising was a low 7%, down from 13% in 2021.

Dry powder, or total unspent PE capital, declined for the region from its record level in 2023. A challenging fundraising environment contributed to the dip.

“Green shoots are appearing in Asia-Pacific’s PE market and despite ongoing challenges and a still uncertain macro environment, fund managers are more optimistic about 2025,” says Prabhav Addepalli, a Bain & Company PE partner, based in New Delhi.

“The region’s fund managers have mixed expectations on future returns, but our survey highlighted a noticeable optimism, with 87% of respondents stating they believe returns will not decrease in the coming three to five years, up from 61% in 2023.”