J.P. Morgan Asset Management ( JPMAM ) aims to become the dominant active exchange-traded fund ( ETF ) provider with the goal of generating US$1 trillion out of a total of US$30 trillion in active ETFs by 2030.

Unveiling the ambitious plan, Philippe El-Asmar, APAC head of ETF, direct and digital at JPMAM, says: “Our headline for 2030 is US$1 trillion of AUM ( assets under management ). We currently have US$240 billion. Our aspiration is to have about US$1 trillion out of the US$30 trillion in 2030 of AUM in the business.”

“We are probably the best active ETF provider in the world, the biggest names you might know have less than one percent of their AUM in active ETFs,” he adds.

Although JPMAM is a latecomer in the ETF business in the region, it is betting on the fact that it currently has the largest actively managed equity ETFs in the world today – the JPMorgan Equity Premium Income ( JEPI ) ETF with about US$37 billion in AUM as of March 2025, and the JPMorgan Nasdaq Equity Premium Income ETF ( JEPQ ) with over US$20 billion in AUM.

Other major active ETF providers, such as Pimco, BlackRock iShares, State Street Global, and Janus Henderson, also have a strong presence in Asia-Pacific and are expected to give JPMAM a run for its money as they also expand their active ETF businesses in the region.

APAC outpaces other regions

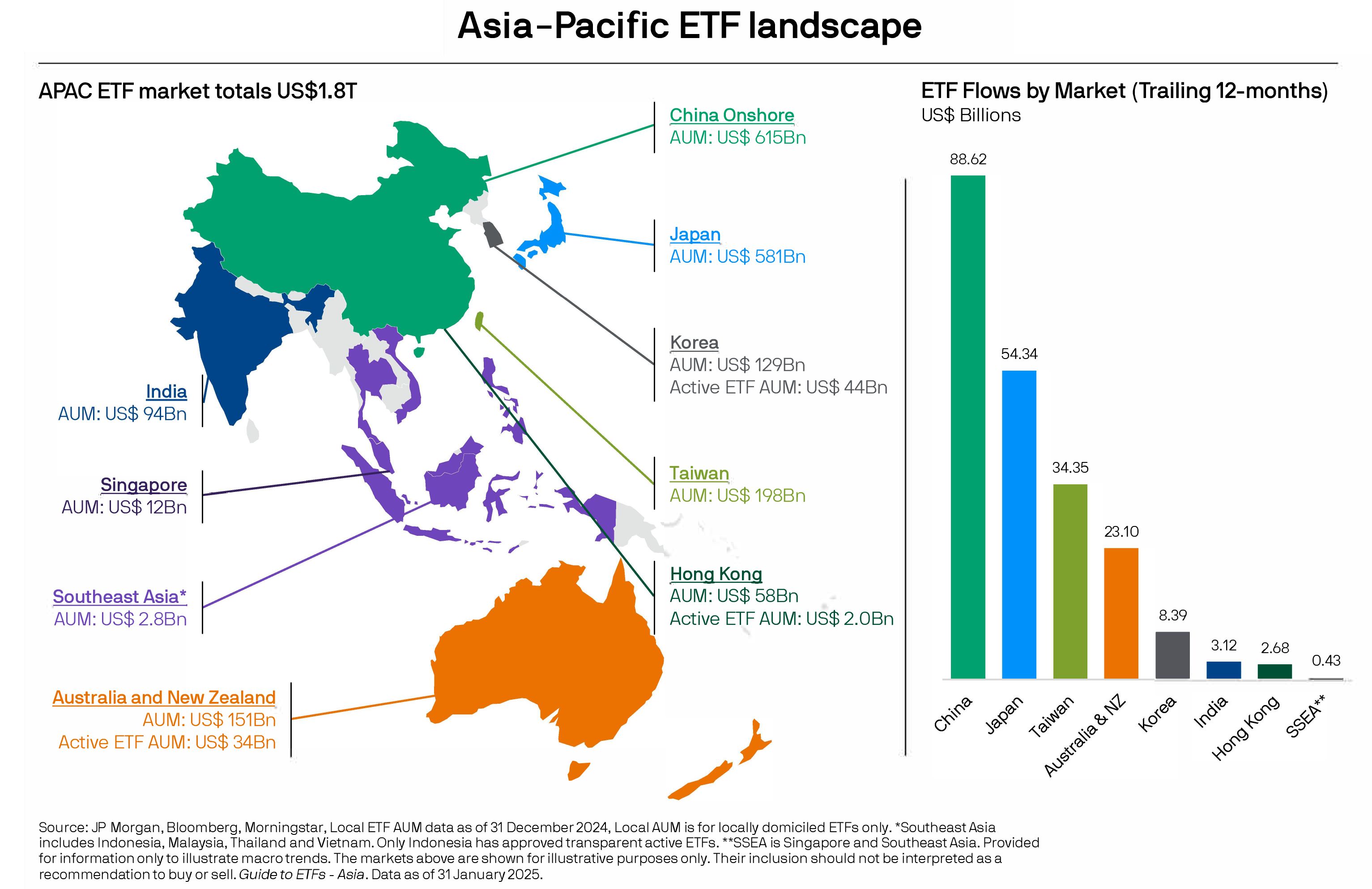

The APAC ETF market has experienced robust growth, with AUM reaching US$1.8 trillion and increasing at an annual rate of approximately 24%, doubling every three years. This growth rate significantly outpaces other ETF regions, where the annual growth rate is around 16%, doubling every five years.

JPMAM is also building out its presence in the region with specialist ETF teams in Australia, China, Hong Kong, Japan, Singapore, Taiwan, and Southeast Asia.

“In order to be able to launch an active ETF, what you need is the full investment capabilities of an active manager. You need the portfolio managers, the research analysts, the investment process. And the thing about J.P. Morgan is that we are the third largest active manager in the world, but we already have portfolio managers in equity, fixed income and liquidity in emerging markets,” El Asmar says in a news briefing.

“Today, although about 60% of ETF flow still goes into market cap-related products, active ETFs now account for one-third of total ETF flows globally compared to only 10% in 2019 when the ETF rule uplift was implemented,” says Rory Caines, ETF specialist for APAC at JPMAM.

The “ETF rule uplift” modernized and streamlined the regulatory framework for ETFs when it was implemented by the US Securities and Exchange Commission in September 2019.

Poised for significant growth

“Driven by increased investor awareness, robust regulatory support, and continuous innovation, the APAC ETF market is poised for significant growth, with China leading the momentum by representing 34% of the total ETF AUM in the region,” says El-Asmar.

“As one of the world’s largest active managers, we are committed to offering our first-class active strategies through the ETF vehicle to meet the evolving needs of both institutional and individual investors. While active ETFs currently represent just 4% of total ETF AUMs in APAC, we see strong momentum in both regulation support and investor adoption.”

As part of its investor education efforts, JPMAM launched the Guide to ETFs in APAC, a quarterly handbook that provides the latest data and information on ETFs.

Globally, there are more than 11,000 ETFs, collectively managing US$15 trillion in assets. Last year marked a milestone with each region setting record net flows, approximately US$1.3 trillion in total, according to the Guide.

ETFs can enhance liquidity in less liquid markets and may be used as price discovery vehicles, particularly during periods of market stress.

And with interest rates seen as having peaked, this is an ideal time to invest in active fixed income ETFs. ETFs offer transparency, liquidity, and a diversified way to access fixed income, limiting the complexities and risks of individual bonds.

ETF assets managed by JPMAM have grown to about US$242 billion over the past five years. JPMAM ranks second in active ETF AUM and eighth overall.